As we enter the third year of the COVID-19 pandemic, health systems across the country continue to face tremendous external pressures on profitability. In the last year alone, we have seen hospital margins decrease by 76%[1] as patients arrive at facilities sicker and treated by an increasingly expensive labor force. Meanwhile, national payers and private equity-backed entrants have doubled-down on their investments in value-based care and are disintermediating health systems through recruiting, acquiring, and partnering with primary care physicians to embed them into their growth strategies. Humana recently announced[2] that it will deploy an additional $1.2 billion of committed capital to develop 100 new senior-focused, payer agnostic primary care clinics. By the end of 2022, Humana expects to serve Medicare patients in approximately 250 CenterWell and Conviva clinics and intends to add 30 to 50 additional CenterWell clinics per year through 2025. CVS Health currently operated 1,500 HealthHub locations and has announced that it intends to close 900 retail stores over the next 3 years as it restructures itself to offer expanded preventive and primary care services in remaining locations to capture a meaningfully greater portion of healthcare spend.[3]

In recent years, health systems have relied upon investment income to offset declining margins as many leading health system CFOs report that they generate three times greater incomes from investment than through operations[4]. However, macro-economic forces may reduce investment incomes and put health systems in a more precarious position than ever before. This leaves health systems with a critical decision – how to diversify revenue streams and build a sustainable business model in an industry that will likely never return to pre-pandemic economics?

Narrowing in on the “disruptor” market, a common theme across payer and physician aggregator business models arises – most are betting on the growth of the 65+ population and the economics of Medicare Advantage and similarly designed fully insured government programs like ACO REACH to drive long-term profitability. As commercial reimbursement deteriorates and the population ages into Medicare products with significantly lower reimbursement rates, health systems can leverage a similar approach to offset the anticipated paradigm shift. A comprehensive senior strategy enables the health system to serve as an anchor in a service area controlling the premium dollar, growing value-based revenues and delivering a superior, integrated experience for their patients.

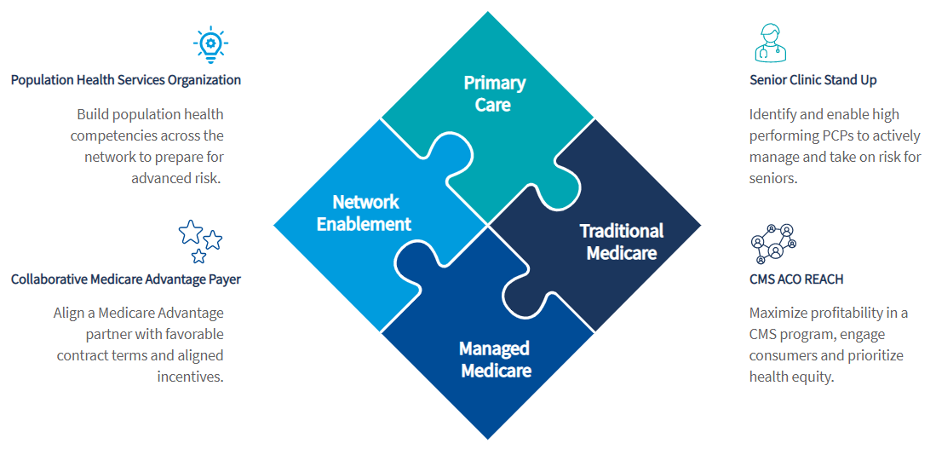

Deploying a market competitive senior strategy requires four fundamental components: network enabling capabilities through population health investment and infrastructure, a strong primary care base, a maximized traditional Medicare program and a collaborative and aligned Medicare Advantage payer. Designing a strategy with all four components allows the health system to build a high performing network that is capable of effectively delivering value-based care complemented by insurance products that ensure appropriate financial incentives for the provider and an engaged, loyal consumer base.

Network Enablement through a Population Health Services Organization

In order to thrive in a value-based, senior-focused environment, physicians and their care teams must have access to 1) predictive analytics that leverage EHR, claims, and SDoH data to prioritize outreach and interventions across populations and lines of business; 2) targeted clinical programs that utilize automation to reduce workforce burden and drive ROI across the clinically integrated network; 3) a robust provider engagement model that promotes shared accountability and mentorship and aligns financial incentives for providers to their value-based contracts.

Primary Care

While directly responsible for a small percentage of medical spend, Primary Care Physicians are critical for effectively managing total cost of care. A key consideration for entering full risk value-based contracts is the creation of a curated network of high performing primary care physicians to operate localized Senior Clinics. Curating a network allows for targeted education and mentorship and the ability to move select physicians into more advanced value-based arrangements ahead of others while also incentivizing performance improvement.

With the appropriate enabling capabilities and network in place, complementary Medicare products are critical for accessing financial incentives and growing value-based revenue.

Traditional Medicare

The MSSP ACO model has historically offered a limited opportunity for health systems to drive change in their networks or improve the consumer experience. The introduction of the ACO REACH model not only prioritizes health equity but enables networks to take on more financial risk and flexibility in program design. This enables networks to create a seamless senior experience when paired with a collaborative Medicare Advantage payer wherein beneficiaries have similar sales and marketing experiences as well as similar supplemental benefit design.

Medicare Advantage

In most markets across the country, the Medicare Advantage landscape is dominated by a large, national payer offering limited alignment to their network partners. Alignment with a collaborative payer enables networks to improve access to the premium dollar to incentivize physicians, fund population health investments and offer an improved consumer experience more effectively.

In deploying this four-pronged strategy, over time the health system is equipped with the tools to enable a high performing physician network as critical asset to the enterprise. This enables the system to maximize performance in insurance products with historically low reimbursement and grow profitability across a diverse portfolio of value-based contracts as they confidently move into advanced risk arrangements across all lines of business.

[1] Kaufman Hall. National Flash Report, May 2022.

[2] Humana Press Release, May 2022

[3] CVS Health Strategy to Revolutionize Consumer Health Experience, December 2021

[4] Leading Health Systems (LHS) Financial Outlook, June 2022