The major story in value-based care in 2022 was undoubtedly mergers and acquisition (M&A) activity related to retail healthcare giants shifting into the care delivery space. This is evidenced by the acquisitions of OneMedical by Amazon, the Signify acquisition by CVS Health, and Walgreens acquiring a majority share in Summit Health-CityMD and their acquisition of CareCentrix.

Retailers dealing with the post-Covid rebound of declining demand and profits are tapping into negative consumer sentiments related to traditional healthcare systems and are scrambling to offer a consumer-focused alternative, right in their neighborhood retail stores—and in the case of CVS and Signify—in the patients’ homes.

Seemingly ahead of the curve, Walmart is already operating 32 health centers in Supercenters in five states[1]. Furthermore, the rush to expand in-person care access, not telehealth, is following the pre-COVID-19 long-held trends, as most people would rather see a doctor in person than on their screen[2].

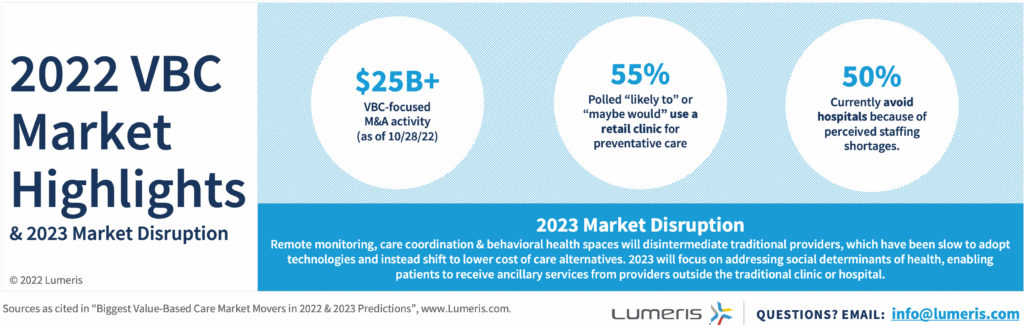

Figure 1: Highlights of 2022 Market Activity.

The retail care ambitions of these companies signal a broader shift in the healthcare ecosystem. Consumers want to have more say in their care, not necessarily at the most prestigious institution (or even online) but instead in-person where convenience is king[3]. In a 2022 survey of US Health Care Consumers conducted by Deloitte Center for Health Solutions, 55% of survey respondents say that they would be “likely to” or “maybe would” use retail clinics for preventive care, and 47% for mental health care.

In 2021, we read about the pending Amazon-ation of healthcare, moving into 2023, we’re going to see the manifestation of this trend. Expect more mergers and acquisitions of larger, established corporations gobbling up care delivery assets. In some cases, incumbent providers, such as Steward Healthcare, are willing to offload care delivery assets. In Steward’s case this is evidenced by the sale of their value-based care MSSP book of business to CareMax, a tech-enabled senior care provider.

This deal, which closed in late 2022, CareMax paid $25 million for the asset, as well as issued more than 23 million shares of common stock which Steward equity holders will retain[4]. These recent market moves seem to indicate that new entrants are learning how to better provide care, much faster and with more opportune financials than incumbents.

Health systems should look to partner with technology companies that are early winners in the value-based care arena, to have a chance to compete with the flux of new entrants in your local strip mall. Expect in 2023 a redefinition of where patients get care, who they get it from, and a monumental shift in patient acquisition strategy.

CMS Strategic Refresh: SDOH & Risk-Based Providers

In spring of 2022, the CMS Innovation Center (CMMI), tasked with innovating Medicare care delivery and payment mechanisms, released their strategic refresh. Their recent strategy focuses on “achieving equitable outcomes through high quality, affordable, person-centered care” focused in six strategic pillars: advance equity, expand access, engage partners, drive innovation, protect programs, and foster excellence. Inherent to CMMI’s strategy is focusing on the consumer experience through expanding coverage and access for Medicare and Medicaid beneficiaries[5]. Does that sound familiar? CMS issued a similar focus on health equity and access when refreshing the Direct Contracting program in February, now known as ACO REACH[6].

Companies aiming to bridge health inequities will continue to become mainstream in 2023. One major barrier for some patients is difficulty affording medications, which Mark Cuban is addressing with his new start-up, Cost Plus Drugs[7]. Initially, Cost Plus was available for patients to pay out of pocket for their medications at much lower prices than they previously paid for their medications through their insurance.

To keep costs low, Cost Plus eliminates the role of pharmacy benefits managers (PBMs), and instead utilizes a direct-to-consumer model selling generic drugs with a 15% mark up from the wholesale price, $3 pharmacy labor charge, and a $5 shipping fee[8]. More recently, Cost Plus has partnered with EmsanaRx, a PBM focused on employer plans, to expand their customer base to self-insured employers[9].

In 2023, market disruption in the remote monitoring, care coordination and behavioral health spaces will disintermediate traditional providers, which have been slow to adopt new technologies and shifting to lower cost care alternatives. By the end of 2023, companies focusing on addressing social determinants of health will be enabling patients to receive ancillary services from providers outside of the four walls of the clinic or hospital.

Staffing Shortages & Automation to Bridge the Gap

It’s impossible to write about 2022 trends without mentioning clinical staffing shortages. What first started in 2020 during the COVID-19 pandemic with a nursing shortage, has snowballed into a nationwide shortage of clinical staff. According to a Health Affairs report, there are 100,000 less registered nurses since 2021, the largest drop in 40 years[10]. While hospitals are struggling to change clinical workflows to operate with less nurses, a recent consumer survey from Global Healthcare Exchange found that 54% respondents believe hospitals need more nurses, and that 50% of respondents avoid receiving hospital care due to concerns over fear of catching COVID-19 or another virus, as related to their concerns over the impact of staffing shortages[11]. How can hospitals bridge the gap, beyond hiring additional nurses at a higher cost?

Look for automation to play a large role in solving staffing shortages in 2023. Though automating repetitive administrative processes won’t replace the necessity for having enough nurses on staff, it can help nurses focus to deliver the best possible patient care. Automation, driven by companies leveraging AI and machine learning, can streamline documentation, medication refills, prior authorizations, and remote monitoring, among many other examples. For hospitals to survive in the competitive labor market in 2023, they will need to create environments for nurses and clinical staff that avoid burnout. Automation will eliminate some of the painstakingly tedious tasks of patient care, likely improving employee satisfaction. Furthermore, some companies, like Incredible Health, are changing the way nurses are hired with new software to match nurses with openings based on qualifications and interest. Look for up-and-coming automation and staffing startups to announce broad partnerships with traditional care providers in 2023.

2022 was a transformative year in healthcare, starting with a booming market and record start-up funding, and closing with a struggling economy, skyrocketing inflation, and hospital margins deep in the red. A market adjustment is well underway, and in 2023 the winners will likely embrace retail primary care, a deeper focus on social determinants of health, and solutions to remedy staffing shortages. Consumer behavior related to accessing care will continue to be influenced by high inflation and shifting attitudes toward traditional healthcare delivery. In 2023, more patients may receive care in new settings, from more startups, and increasingly facilitated by technology and automation. Hope springs eternal for healthcare in 2023: bridging health inequities and improving access to care, both of which are long overdue.

2 https://media.jamanetwork.com/news-item/patient-preferences-for-telehealth-post-covid-19/

3 https://www2.deloitte.com/us/en/insights/industry/health-care/alternative-sites-of-care.html

5 https://innovation.cms.gov/strategic-direction-whitepaper

10 https://www.healthaffairs.org/do/10.1377/forefront.20220412.311784/