What Leading Consultants are Talking About: Takeaways from the Lumeris Value-Based Care Leadership Summit

Earlier this month in Dallas, Lumeris had the privilege of hosting 30 of the industry’s top value-based care consulting leaders at our inaugural Value-Based Care Leadership Summit. The event started with a networking dinner and fireside chat with Lumeris CEO Mike Long, followed by a full day of discussion with a senior group of strategic advisors on topics related to value-based care. Our goal was to collectively share insights from our experiences helping healthcare organizations on their journey to value.

Takeaways from the discussion:

- Political Update and Implications of the Midterms on Healthcare.

Andrew McKechnie of Peck Madigan Jones outlined how the changes over the past year and political realities could impact the healthcare industry going forward.

- With a Democratic majority in the House of Representatives, there is an expectation that they may halt many legislative changes to healthcare; however, the regulatory bodies still will look to significantly impact change. Areas of focus could be a crackdown on ‘surprise’ billing and efforts to relax anti-kickback/Stark law to support value-based care arrangements.

- The outlook for Medicare Advantage is highly favorable from a regulatory perspective without any expected disruptive changes to the program and continued support from the Hill and President Trump.

- Big pharma is the most vulnerable healthcare industry segment with increased regulation being broadly popular and a rhetorical punching bag for President Trump. Despite a divided congress and unprecedented levels of partisan polarization, changes impacting drug costs could receive support from both sides of the aisle.

- With the 2015 change to the Medicare Sustainable Growth Rate, or ‘Doc Fix’ law, the Medicare Extender renewal process may be the next semiregular vehicle to advance healthcare legislation. The last agreement in 2017 included two- and five-year extensions of policies with some elements up for renewal in 2019.

- Provider Sponsored Health Plans: Why do they fail, AND a Recipe for Success.

Cathy Eddy, founder and former President of the Health Plan Alliance, and Debbie Zimmerman, M.D., Lumeris Corporate Chief Medical Officer, led a discussion on the common reasons that provider sponsored health plans (PSHPs) fail, and key components that lead to success.

Characteristics of Failure:

- Short-Term Vision: Inability to stomach the necessary investments or initial years of losses in insurance products due to a focus on the near future;

- Limited Expertise: Absence of insurance business competencies on health system leadership teams and boards leading to mismanagement; and

- Misaligned Business Objectives: Lack of true system integration; running multiple and competing business lines that are at odds with necessary controls on cost and utilization to operate a profitable PSHP.

Characteristics of Success:

- Focused Strategy: Starting small in targeted geographies and with a narrow network product that the provider organization has influence over;

- Leveraging the Brand: Learning the art of selling a narrow network product by leveraging the health system brand and offering competitive benefits with obvious cost differences for consumers; and

- Partnering Where Gaps Exist: Partnering to gain expertise and fill key operational gaps.

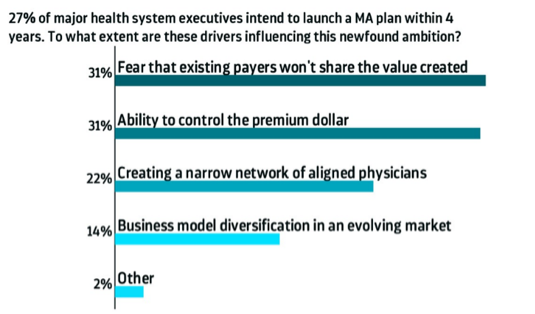

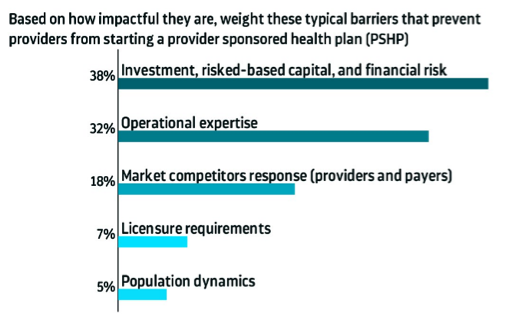

The participants gave their perspective on the recent interest from providers looking to start health plans; both on what is pushing providers toward starting plans and what may also be holding them back:

The attendees have observed that health systems want to control their financial futures by owning the value they help create and a larger share of the premium dollar, but also lack the financial and operational resources to realize that vision.

- ROI on the Transition to Value.

Lumeris’ Jeff Smith, Executive Vice President of Markets, and Ross Armstrong, Senior Vice President and Market Head, led a discussion on the financial considerations and cost of delaying business model changes in the face of daunting demographic and market trends.

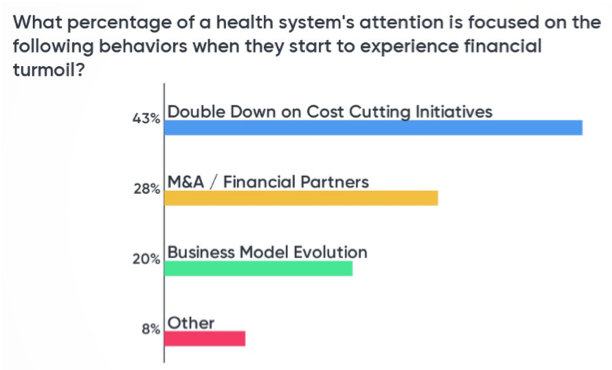

The risks of health systems maintaining the status quo, fee-for-service model when facing serious demographic trends far outweigh the challenges of transitioning to value. However, when financial turmoil hits, the consultant attendees have observed health systems doubling down on traditional cost-cutting measures and M&A /financial partner activities and focusing less on advancing to value-based models of business.

The risks of health systems maintaining the status quo, fee-for-service model when facing serious demographic trends far outweigh the challenges of transitioning to value. However, when financial turmoil hits, the consultant attendees have observed health systems doubling down on traditional cost-cutting measures and M&A /financial partner activities and focusing less on advancing to value-based models of business.

This highlights the importance of health systems making a strategic decision to invest in value infrastructure from a position of strength since they risk falling short from a financial perspective when industry trends force their hand.

The presenters also used a case study of a large health system that had to reexamine its financial position and decide whether to move to risk given the evolving demographic and business model trends. The case reviewed tangible volume, utilization, financial and demographic data to uncover the inflection point for the health system to make a sizable investment in value with the expectation of return on investment while balancing its existing fee-for-service business.

- Engaging Providers and Overcoming Critical Objections to the Move to Value

Dr. Zimmerman’s discussion focused on provider engagement and how to properly align powerful financial and non-monetary incentives to speed the transition to value and increase the likelihood of success.

- Linking value-based incentives to metrics at the physician group and individual level creates multiple levels of accountability and better buy-in from physicians and clinical leadership.

- To incentivize behavioral changes, physicians need 10-20 percent of their patient panels in value-based contracts.

- Roughly 20-30 percent of a primary care physician’s compensation should be linked to value creation in order to move the needle on provider engagement (i.e., value-based contract performance, incentives linked to value behaviors, etc.).

- Physicians must have the opportunity to increase their total compensation in value-based contracts if they are high performers in advanced risk-bearing models.

- Analytics for Value-Based Care: Where We Are and Where We’re Going

Pete Smart, Senior Director of Reporting and Analytics at Cerner, and Ben Alexander, M.D., Chief Medical Officer of Population Health Analytics at Lumeris, led the discussion around how health systems are currently using analytics in value-based care and the potential for future technologies to change how effective we are at managing populations and driving outcomes.

Despite billions of dollars invested in data and IT infrastructure and many investors making bets on technologies to revolutionize healthcare, health systems remain relatively unsophisticated from an analytical perspective when trying to convert information into actionable insights at the point of care.

Health systems are starved for data insights that are accurate, continuous and actionable. Well-funded value propositions are focused on these characteristics to support healthcare organizations and impact clinical and financial outcomes.