In this three-part Perspectives series, we’ll look at the drivers forcing healthcare’s move from volume to value, first focusing on unsustainable economic forces. Then we’ll examine why Medicare Advantage is critical for a successful value strategy.

Inertia in healthcare is indeed a powerful force, but adopting a wait-and-see approach is not sufficient. Ready or not, the marketplace is changing, and providers that don’t adapt will be left behind. How should providers deal with the daunting change required—and why is it inevitable?

Sparked by the 2010 Affordable Care Act, reforms to slow unsustainable healthcare cost growth have already taken root. Medicare has led the charge with its experiments in accountable care organizations (ACOs), bundled payments and value-based purchasing. The revamping of Medicare’s physician payment system to reward value under the 2015 Medicare Access and CHIP Reauthorization Act is now in its second implementation year. And private payers are following Medicare’s lead.

Consider this: the top five commercial insurers have engaged in 184 publicly announced value-based payer-provider contracts as of August 2017, notes the Health Care Transformation Task Force, a consortium of stakeholder organizations committed to value-based care.[i] Payers have begun to favor such arrangements as ACOs and capitated contracts that ask providers to take on more financial risk.

| Health Insurer | Value-based Contracts (2015-2017) |

| Cigna | 56 |

| Humana | 54 |

| Aetna | 40 |

| UnitedHealth | 19 |

| Anthem Blue Cross Blue Shield | 15 |

| Source: Health Care Transformation Task Force, NEJM Catalyst | |

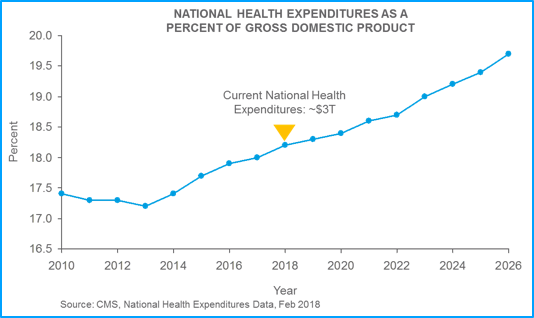

Moreover, CMS recently announced that U.S. healthcare expenditures will grow from $3.7 trillion today (18.2 percent) to $5.7 trillion — 19.7 percent of the GDP — by 2026.[ii] This growth will add momentum to the push to move from volume-based to value-based care models. The nation simply cannot afford to stay on this path if it insists on being a world leader.

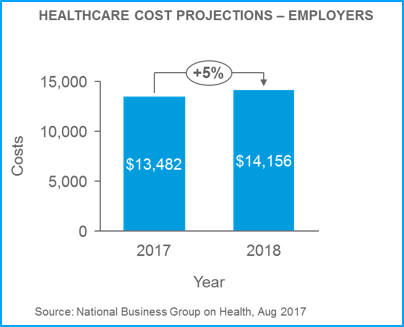

As healthcare markets evolve, US businesses are also applying pressure for reform. Anticipating another 5 percent increase in healthcare benefit costs in 2018, growing numbers of large employers are focusing on changes in healthcare delivery and payment to control costs, according to the National Business Group on Health.[iii]

The result will lead to more employers promoting ACOs, embracing bundled payment arrangements with centers of excellence, and turning to value-based benefit designs that reward employees when they take steps to manage chronic conditions or obtain higher-quality, more efficient care. Even organizations outside of the healthcare space are demanding better outcomes and trying to impact the value equation themselves.[iv]

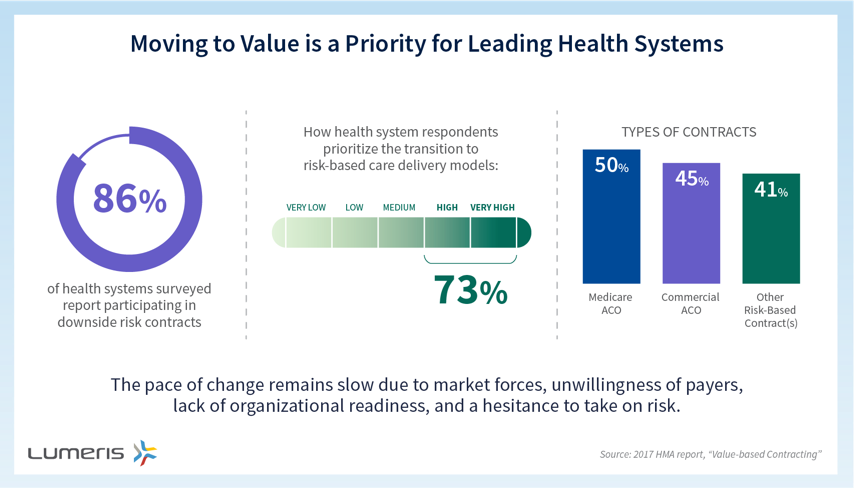

The country’s top health systems are responding to these market forces. In a 2017 survey of 22 leading systems by The Health Management Academy, 86 percent reported that they are participating in some type of downside-risk contract with payers.

However, in follow-up interviews with leaders from 12 of the systems, organizations revealed that they fall across a spectrum in their journey to value, with experience levels ranging from beginner to advanced.

The survey, funded and published by Lumeris and Health Management Academy (The Academy), reflects the reality that the move to value is a difficult, complex process that requires health systems to acquire new approaches and skill sets. Common challenges include aligning physician incentives with quality and cost goals, transforming care delivery, developing capabilities and expertise traditionally associated with payers, and collecting, aggregating, and disseminating actionable data to drive clinical and financial performance. Nevertheless, these systems are making the move a priority.

The march toward value is not going to stop. Public and commercial payers and employers can’t afford the fee-for-service status quo with its ever-increasing price tag. Consumers footing more of the bill won’t allow it to stand over time.

As a result, providers must be prepared to manage more of the premium dollar. Developing the right capabilities requires commitment, behavior change, and investment. The choice remains: stand on the sidelines as the rest of the industry marches on, or find the right strategy to drive real change. What side will you choose?

In Part 2 of this series, we’ll explore why Medicare Advantage is a model that drives the changes needed for value-based care delivery and financing.

References

[i] https://catalyst.nejm.org/economic-investment-journey-health-care-value-part-ii/

[ii] https://www.cms.gov/research-statistics-data-and-systems/statistics-trends-and-reports/nationalhealthexpenddata/nhe-fact-sheet.html

[iii] https://www.businessgrouphealth.org/news/nbgh-news/press-releases/press-release-details/?ID=334

[iv] https://www.businesswire.com/news/home/20180130005676/en/Amazon-Berkshire-Hathaway-JPMorgan-Chase-partner-U.S